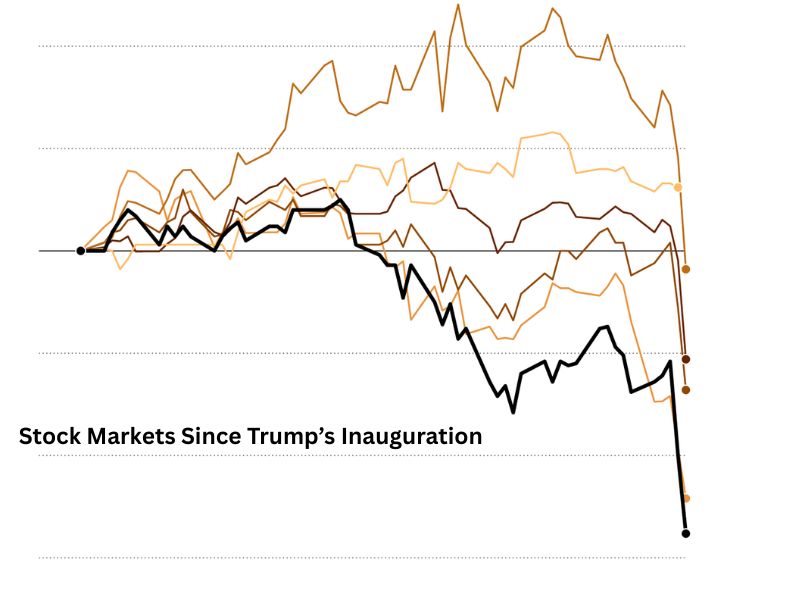

A major stock market crash shook Wall Street on Friday after former President Donald Trump unveiled a sweeping new tariff plan. The Dow Jones Industrial Average dropped 1,800 points, while the S&P 500 declined 5%, triggering fears of a global economic downturn.

China swiftly responded to the proposed tariffs with retaliatory duties of up to 34% on US imports, sparking fears of a full-blown trade war. Analysts say the move could have long-lasting effects on global trade and economic growth.

“This is no longer a drill. The trade tensions have escalated into a dangerous standoff,” said Lauren Michaels, chief strategist at Hudson Analytics. “The market is reacting to real risks now — not just headlines.”

Panic Hits Wall Street

- The Dow Jones closed down 2,231 points,

- The S&P 500 fell 6%,

- The Nasdaq entered bear market territory — down more than 20% from its recent high.

In just two days, nearly $6.6 trillion in market value has been wiped out.

Investors Rush to Safety

As fears of recession grow, investors are moving into safe-haven assets like US Treasury bonds. The yield on the 10-year note dropped below 4% for the first time this year, signaling a massive shift in sentiment.

Only 14 stocks in the S&P 500 managed to post gains on the day, while over 28 companies saw double-digit losses. Tech and industrial sectors were among the hardest hit, with companies like Apple, Boeing, and Tesla suffering significant declines.

Global Ripple Effect

Markets around the world echoed the chaos on Wall Street. Japan’s Nikkei 225 dropped more than 3%, while London’s FTSE 100 lost nearly 2.5%. Oil prices also fell sharply, with Brent crude dropping to $62 per barrel — its lowest since 2021.

White House Defends Tariff Move

Despite market panic, Trump doubled down on his tariff stance, stating, “Now is the best time to get rich. China made a mistake, and they’re panicking.” However, other officials took a more measured tone.

“We’re seeing a market correction, not an economic collapse,” said Secretary of State Marco Rubio. “American businesses will adjust and come out stronger.”

Still, economists warn the combination of rising tariffs, inflation concerns, and slowing global growth could trigger a broader economic slowdown.

What’s Next?

Friday’s jobs report showed 228,000 new jobs were added last month, indicating a still-strong labor market. But Wall Street’s focus remains on the escalating tariff battle and whether the Federal Reserve will be forced to intervene.

“This is a true test of market resilience,” said Michaels. “Unless we see de-escalation soon, the stock market crash could be just the beginning of a longer period of instability.”