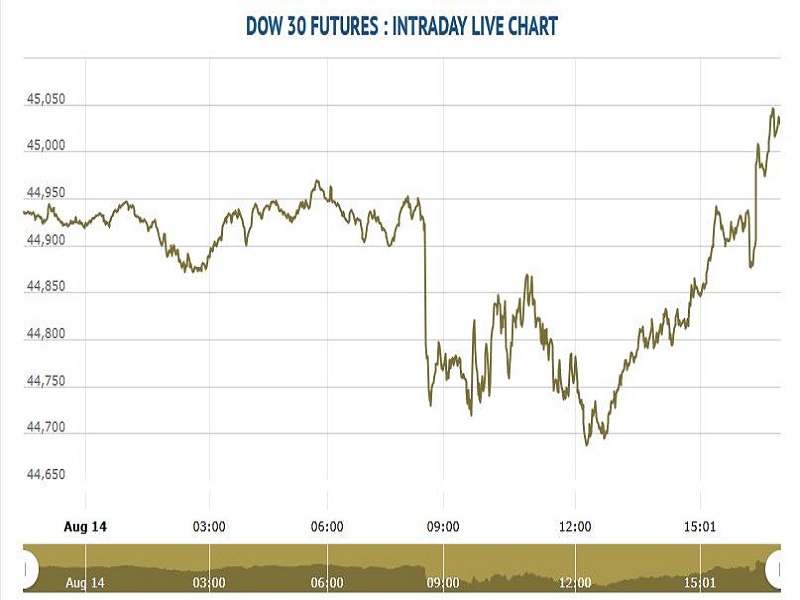

U.S. stock index futures traded slightly higher early Thursday, with Dow Jones futures edging above fair value while S&P 500 and Nasdaq 100 futures ticked up modestly. Investors await fresh economic data, including weekly jobless claims and the Producer Price Index (PPI) due at 8:30 a.m. ET. The 10-year Treasury yield eased to 4.2% ahead of the reports.

On Wednesday, Wall Street’s rally extended further as the S&P 500 and Nasdaq hit fresh record highs, while the Russell 2000 small-cap index surged to a six-month peak. The Dow Jones Industrial Average jumped 1%, the S&P 500 gained 0.3%, and the Nasdaq added 0.1%. Small caps continued their momentum, with the Russell 2000 soaring 2% after a 3% jump on Tuesday.

Earnings and Stock Moves

Cisco Systems (CSCO) posted better-than-expected fiscal Q4 earnings late Wednesday and offered upbeat guidance. However, the stock edged lower in premarket trade after closing down 1.6% at $70.27. Coherent (COHR) reported mixed results, guiding slightly lower for the current quarter and announcing the $400 million sale of its aerospace and defense unit to Advent; its shares fell sharply after hours. Deere (DE) beat profit expectations but trimmed full-year guidance, sending the stock lower in early trade.

Meanwhile, Nvidia-backed CoreWeave (CRWV) plunged 20.8% on mixed results and ahead of an IPO lockup expiration. Oracle (ORCL) lost 3.8% amid reports of layoffs in its cloud infrastructure division. AI-related hardware and infrastructure names including Comfort Systems (FIX), Vertiv (VRT), and Argan (AGX) fell, while AI chipmakers Nvidia (NVDA) and AMD (AMD) fared better — Nvidia dipped 0.9% and AMD jumped 5.4%.

Sectors and ETFs

Homebuilders, financials, biotech, and Chinese stocks saw notable strength, supported by easing Treasury yields. The SPDR S&P Homebuilders ETF (XHB) surged 3.9%, while ARK Genomics ETF (ARKG) leapt 4.5%. Energy stocks also advanced, with the Energy Select SPDR ETF (XLE) gaining 1.15%.

Stocks in Buy Zones

- Blackstone (BX) rose 1.6% to $176.60, nearing a 181.32 cup-with-handle buy point.

- ELF Beauty (ELF) jumped 5.3% to $122.92, breaking above key technical levels.

- KLA Corp. (KLAC) climbed 1.5% to $949.48, topping a 945.87 buy point.

- Tempus AI (TEM) soared 7.2% to $76.94, clearing a cup-base entry and now up over 14% this week.

Market Outlook

Analysts note that the rally may be broadening beyond AI hardware, with strength rotating into sectors such as housing, finance, and healthcare. However, with volatility in AI-related stocks, traders are advised to balance positions — holding onto leaders while trimming exposure in names showing weakness.

U.S. crude oil prices fell 0.8% to $62.65 a barrel on Wednesday. The 10-year Treasury yield slipped 5.5 basis points to 4.24%.